Mutual of Omaha Life Insurance

Flexible Coverage, Trusted Protection, and Lifetime Value

If you’re looking for Mutual of Omaha life insurance, you’re choosing a company with decades of financial strength, competitive pricing, and products designed to protect individuals and families at every stage of life. At Life Insured By Chris, we help clients secure the right Mutual of Omaha policy whether you need final expense coverage, term life insurance, whole life protection, or supplemental accident coverage.

Mutual of Omaha offers dependable solutions focused on affordability, guaranteed benefits, and long-term security, making it a trusted choice for seniors, families, and individuals seeking peace of mind.

Why Choose Mutual of Omaha Life Insurance?

Mutual of Omaha life insurance products are known for simplicity, strong underwriting, and reliable benefits especially for seniors and families looking for permanent or straightforward protection.

Key benefits of Mutual of Omaha life insurance include:

Senior-focused final expense and whole life options

Flexible term life coverage for income protection

Guaranteed premiums on whole life policies

Policies designed for easier approval

Strong financial backing from a nationally trusted insurer

As an independent life insurance brokerage, Life Insured By Chris helps you compare Mutual of Omaha with other top-rated carriers to ensure you receive the best coverage for your needs, health profile, and budget.

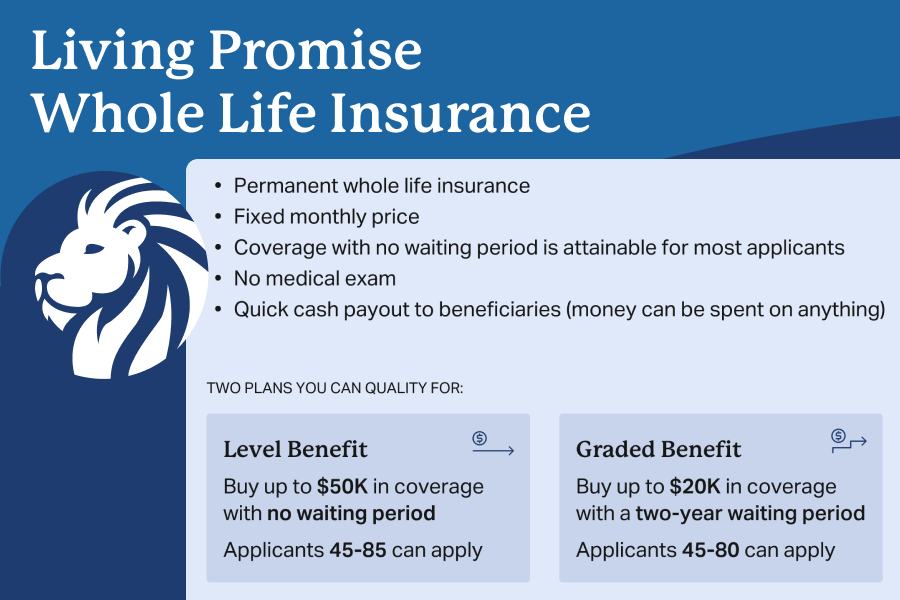

Mutual of Omaha Living Promise Final Expense Insurance

Affordable Whole Life Coverage for Funeral and Legacy Costs

Living Promise Final Expense is one of Mutual of Omaha’s most popular products, designed specifically for seniors who want affordable, permanent coverage to handle end-of-life expenses.

Key features include:

Lifetime whole life insurance coverage

Fixed monthly premiums that never increase

Coverage amounts designed for funeral, burial, and medical expenses

Options for immediate or graded benefits based on health

Simple application process

Living Promise is ideal for individuals who want to protect loved ones from financial burden while leaving a meaningful legacy.

Mutual of Omaha Term Life Insurance

Flexible Protection for Families and Income Replacement

Mutual of Omaha offers multiple term life products designed to protect your family during critical earning years.

Term Life Express®, Term Life Answers®, and EZ Term®

These policies provide affordable, flexible coverage with options to match your specific situation.

Benefits include:

Coverage terms to fit short- or long-term needs

Competitive rates for healthy individuals and families

Simple underwriting options for faster approvals

Ability to convert to permanent coverage in many cases

Term life insurance is ideal for mortgage protection, income replacement, debt coverage, and protecting loved ones during key life stages.

Mutual of Omaha Children’s Whole Life Insurance

Lifetime Protection That Grows With Your Child

Children’s Whole Life insurance provides permanent life insurance coverage for children, locking in low premiums for life while building cash value over time.

Key advantages include:

Guaranteed lifelong coverage

Level premiums that never increase

Cash value accumulation over time

Ability to purchase additional coverage in the future without medical underwriting

This policy is a smart way to provide lifelong financial protection and future insurability for your child.

Mutual of Omaha Senior Choice Whole Life Insurance

Permanent Coverage Designed for Older Adults

Senior Choice Whole Life is built specifically for older adults seeking dependable lifetime coverage with predictable benefits.

Highlights include:

Permanent whole life insurance coverage

Fixed premiums and guaranteed death benefit

Simplified underwriting for easier approval

Ideal for legacy planning and long-term security

This product is well-suited for seniors who want straightforward, guaranteed protection without complexity.

Guaranteed Advantage Accidental Death Insurance

Supplemental Protection for Unexpected Accidents

Guaranteed Advantage Accidental insurance provides accident-only coverage that pays a benefit if death occurs due to a covered accident.

Key features include:

Guaranteed acceptance with no medical exam

Affordable premiums

Supplemental protection alongside existing life insurance

Coverage designed for added peace of mind

This plan works well as an additional layer of protection for individuals looking to enhance their overall financial safety net.

Work With a Trusted Mutual of Omaha Life Insurance Agent

Choosing the right life insurance policy doesn’t have to be overwhelming. As an independent brokerage, Life Insured By Chris works on your behalf helping you compare Mutual of Omaha life insurance products with other top carriers to ensure you receive the best value and coverage.

We take the time to understand your goals, explain your options clearly, and guide you through the application process from start to finish.

Get a Free Mutual of Omaha Life Insurance Quote Today

✔ No obligation

✔ Personalized recommendations

✔ Coverage tailored to your needs and budget

👉 Request your free quote now

👉 Schedule a consultation

Policy availability, features, and riders vary by state. All policies are subject to underwriting and terms and conditions. Benefits and payouts vary by product. This content is for informational purposes only and does not constitute a contract.

Resources

Explore More Coverage Options

- Compare Americo life insurance coverage

- Explore our full list of life insurance carriers

- See Foresters life insurance options